Corridor Inference DCs

Dense metro-pair hubs

Trionic Capital Partners offers Sovereign Wealth Funds, institutional investors, private equity, and real estate developers exclusive access to secure, sustainable investment vehicles capitalizing on today's most compelling generational opportunity in AI infrastructure.

Fund

Target

Target Number of

Investments

Target

Cash Flow

Target

IRR

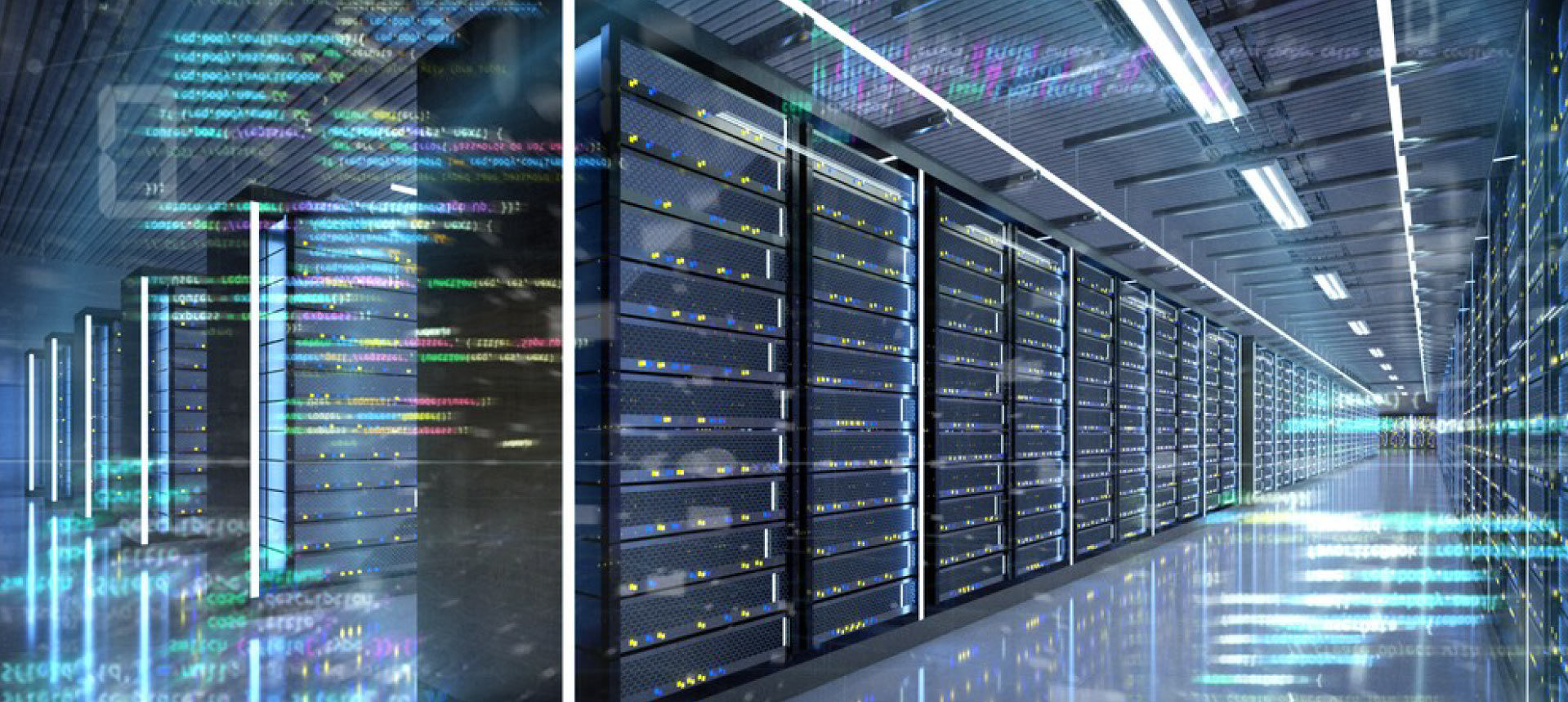

AI-native, high-density infrastructure with advanced cooling (30–100kW/rack), 100% renewable power and carbon tracking, predictive AI/ML management, ultra-low-latency optical edge connectivity, and off-grid fuel cell/hydrogen/natural gas energy generation.

Tier IV, 99.999% uptime data centers with PUE < 1.2, built-in compliance, modular scalability, hybrid cloud integration, real-time monitoring, and multi-region disaster recovery.

Prime edge sites near undersea cables and underserved areas, ESG-aligned for green financing, with hyperscale partnerships, vertical-specific compliance, and strategically placed AI Factories along metro hubs, broadband, and pipeline corridors.

Legacy data centers ready for AI retrofits

Yield-enhancing PPP projects (e.g., Oklahoma along gas pipelines)